NFX

Engineering Network Effects

Network effects. The term is bandied about in venture capital circles and startup manifestos with almost mystical reverence, as if it were some alchemical formula that magically transmutes user numbers into market dominance. Founders invoke it, hoping to conjure moats around their nascent businesses. In business, a ‘moat’ refers to a competitive advantage that protects a company from its rivals, just as a moat protects a castle from invaders. Investors nod sagely, seeing in it the promise of exponential returns. But let’s be clear: network effects are not pixie dust you sprinkle on a product. They are potent, objective, and fundamental, much like the resilience or clear value proposition I’ve insisted upon. Like those other fundamentals, they are either deliberately engineered into the DNA of your product or remain an elusive dream.

Many confuse simple popularity with genuine network effects. A product can acquire many users without its intrinsic value increasing for each user as a direct consequence. True network effects create a powerful, self-reinforcing loop where each new user tangibly, often exponentially, enhances the value of the product or service for all existing and future users. This isn’t just growth; it’s a compounding advantage, a gravitational pull that makes your product increasingly indispensable.

The Many Faces of a Formidable Moat

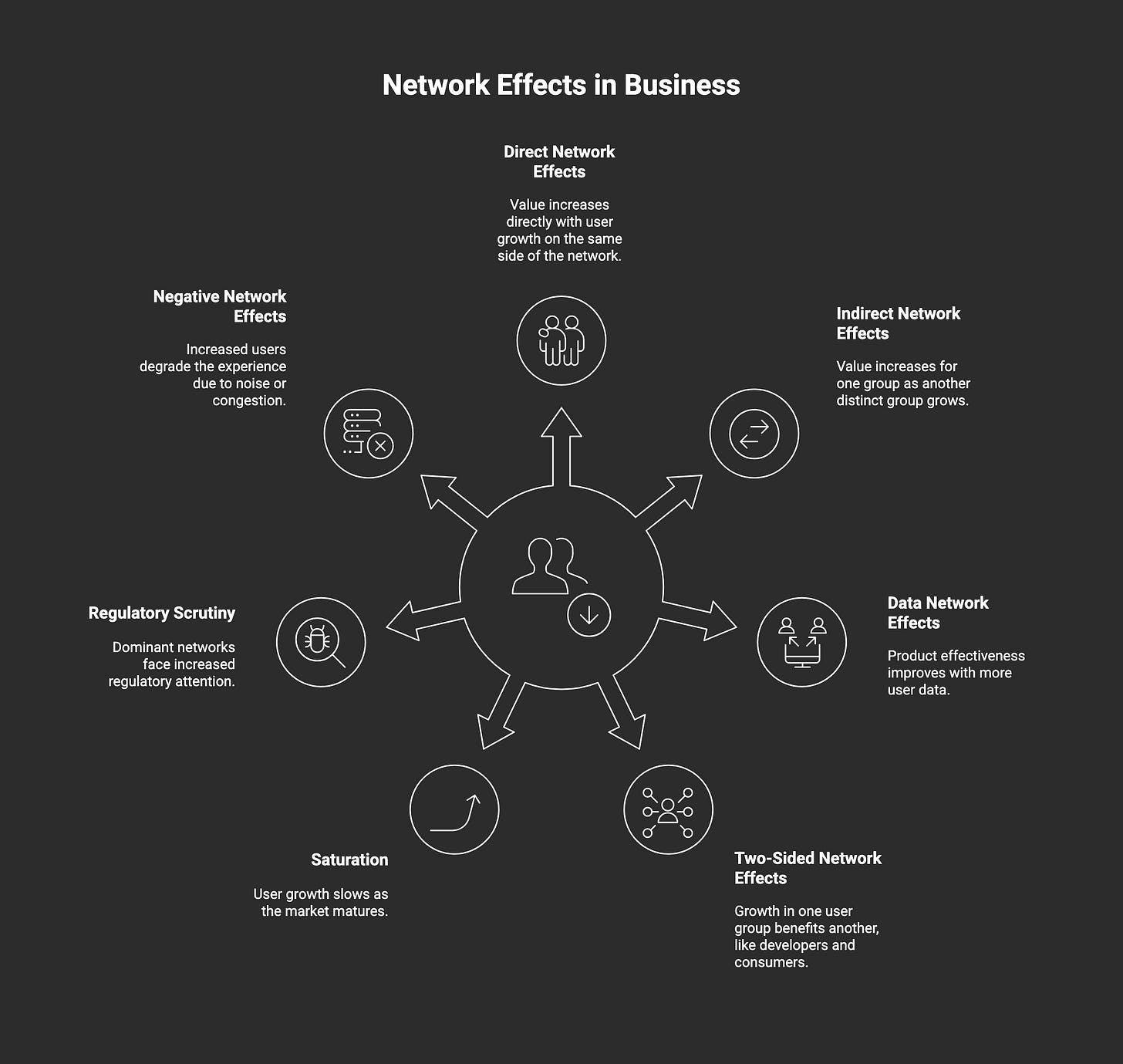

Network effects aren’t a monolithic entity; they manifest in several distinct, often overlapping, ways. Understanding these flavors is crucial if you intend to harness their power:

Direct Network Effects: This is the most straightforward form of network effects. The value for each user increases directly with the number of other users on the same side of the network. Think of WhatsApp or Facebook; their utility is almost entirely derived from the presence of your contacts. Each friend who joins makes the platform more valuable to you. Similarly, LinkedIn’s value increases as more professionals join, and Airbnb becomes more useful as more hosts and guests sign up.

Indirect (or Cross-Side) Network Effects: Here, the value for one group of users increases as another distinct group of users grows. Uber is a classic example: more drivers attract more riders, and more riders attract more drivers. Marketplaces like Amazon thrive on this dynamic, connecting buyers and sellers; the larger one group, the more attractive the platform becomes to the other. Kickstarter, too, leverages this by connecting creators with backers.

Data Network Effects: Some products become inherently smarter and more effective as more users engage with them, feeding data into the system. Google Search is a prime example; every query and click helps refine its algorithms, delivering more relevant results for everyone. This creates a powerful learning loop.

Two-Sided Network Effects: Often observed in platforms, this phenomenon is similar to indirect effects, where growth in one user group (e.g., app developers for an operating system like Windows) increases the value for another user group (e.g., consumers purchasing computers with that OS). Zapier demonstrates this with its vast ecosystem of app integrations; the more apps it connects, the more valuable it becomes to users seeking automation between their tools.

And then you have businesses like Amazon, which masterfully layer multiple network effects: a two-sided marketplace, data network effects from purchase and search behavior, and even a closed-loop effect with Prime membership, which encourages frequent purchases, attracting more sellers. This multi-layered approach creates an almost unassailable competitive advantage.

Signals from the Noise: Measuring Real Network Effects

So, how do you distinguish true network effects from mere growth Hype? The signals are in the data, but not the vanity metrics that often cloud judgment. As I’ve said about GTM strategies, you must measure what truly matters.

Cohort Retention Analysis: This is perhaps the most telling indicator. Suppose users who join your network later (when it’s larger and theoretically more valuable) retain at a higher rate than earlier cohorts did at the same point in their lifecycle. In that case, that’s a strong signal that your network is becoming more valuable over time.

Engagement Deepening with Network Size: Track core value-creating actions to enhance engagement. Do users send more messages, complete more transactions, or consume more content per user as the network expands? You’re on the right track if engagement per user scales with network size.

Organic Growth Dominance: As network effects strengthen, an increasing number of your new users should come through organic channels – such as word-of-mouth, direct invitations, or network-driven discovery – rather than paid acquisition. ‘Organic growth’ refers to a company’s growth that comes from within, as opposed to development that is achieved through mergers and acquisitions or other external means. The network itself becomes your most powerful growth engine.

Marketplace Liquidity (for two-sided networks): Metrics such as the percentage of listings that result in transactions, the time it takes to match a buyer and a seller, and a balanced buyer-to-seller ratio are critical. High liquidity means the network is efficiently creating value for both sides.

If these metrics aren’t trending positively, you might have growth but not the compounding defensibility of true network effects.

The Perils: When Networks Stumble

While powerful, network effects are not without their challenges and risks. Growth isn’t always an unalloyed good.

Saturation: User growth inevitably slows as platforms mature and saturate their addressable markets. Companies like Facebook have faced this challenge, forcing them to innovate relentlessly to maintain engagement and explore new avenues for growth.

Regulatory Scrutiny: Dominant networks often attract regulatory attention. Concerns over data privacy, antitrust issues, and market power can lead to significant operational impacts, as seen with Google and Facebook globally.

Negative Network Effects (Pollution & Congestion): Sometimes, an increase in users can degrade the experience. Think of social feeds overwhelmed by noise, marketplaces diluted by low-quality listings, or review platforms manipulated by bad actors. This is the “tragedy of the commons” playing out in digital spaces, where the actions of a few can diminish the value for all. Managing this requires robust curation, moderation, and governance.

Engineering Your Unfair Advantage

Leveraging network effects isn’t about luck but foresight and deliberate design from the earliest stages. As I emphasized in my thesis regarding ancillary services, understanding your ecosystem and role is paramount. Building in network effects requires identifying how connections between users, data points, or complementary services can create escalating value.

It’s about creating a system where the very act of using the product contributes to its betterment and magnetism. It’s about recognizing that in the brutal, competitive landscape I’ve often described as zero-sum, genuine network effects are one of the few ways to build a truly differentiated and resilient business. They are not just a passive benefit, but an active, strategic imperative. In the Darwinian struggle for market survival, it’s one of the most potent adaptations a business can possess.